When thinking about innovative businesses, technology-enabled companies likely come to mind. Indeed, nine out of ten of Fast Company‘s 2017 ‘World’s Most Innovative Companies‘ are driven by technology. In many cases, innovation drives business value, and thus its perhaps not surprising that the technology sector’s five largest companies (Apple, Alphabet/Google, Amazon, Facebook, and Microsoft), long recognized as among the leaders in business innovation, recently reached a new financial threshold, being worth $3 trillion in market value in aggregate.

Looking at the technology ‘Big 5,’ along with other companies at the top of Fast Company‘s ranking (i.e., Uber, Snap, Netflix, Spotify), one thing becomes clear: as much as these companies depend on technology, they are equally, or especially, reliant on the internet and their customers’ access to it.

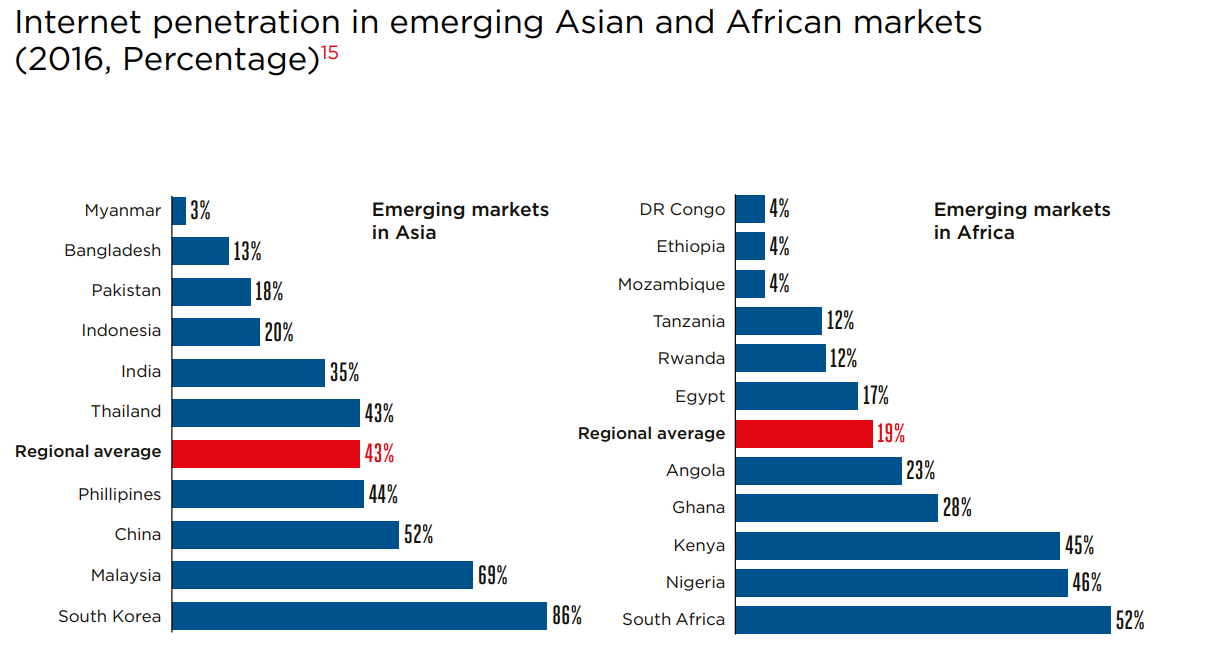

In sub-Saharan Africa however, the average internet penetration rate stands at 19% according to analysis from the GSMA and Dalberg:

Don’t miss this overview of growth in the sub-Saharan Africa mobile market. With mobile often being the only form of internet connectivity available to consumers in sub-Saharan Africa, the commercial benefits of the internet to innovative companies will be driven by mobile.

Smartphone adoption in the region is less than 30% however, compared to the global average of 50%, and 75-80% in Europe & North America. (The gap between smartphone adoption and internet penetration in the region is linked to mobile data costs & other factors.)

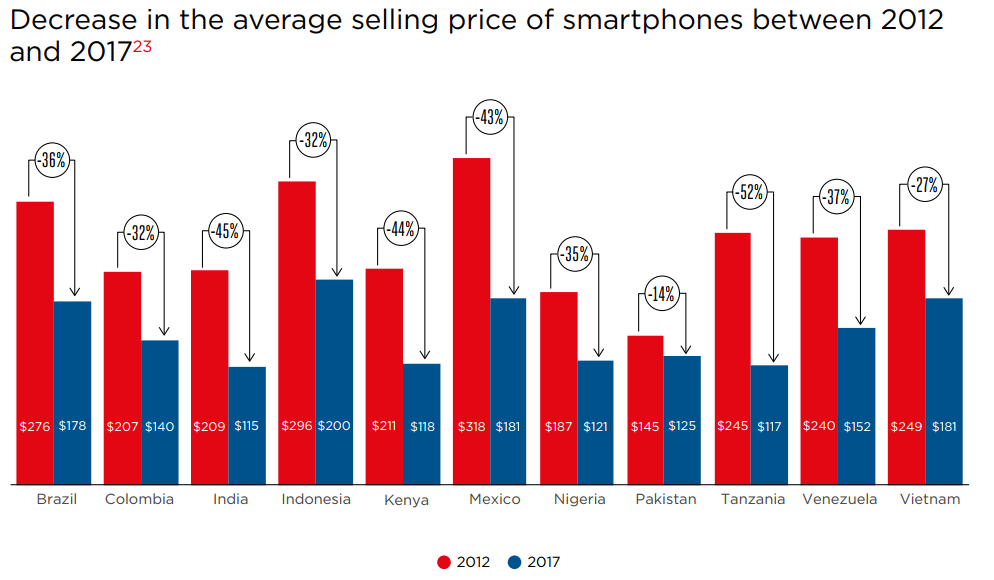

Among the various factors driving low smartphone adoption levels in sub-Saharan Africa, the cost of devices is a notable one.

While smartphone prices have fallen, on average they still cost between $100-$200 in many emerging markets, as shown in the chart above. For many low-income consumers living at the base of the pyramid, these prices are still out of reach, especially compared to income levels.

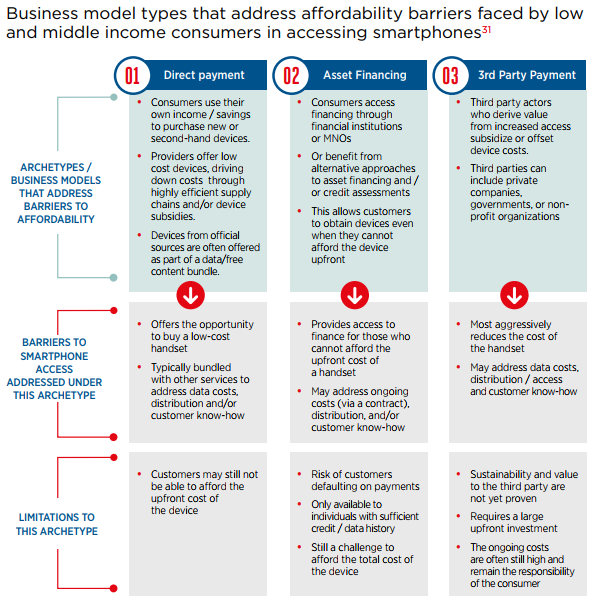

However, the vast number of these consumers and the tremendous potential getting them online represents is a massive opportunity, thus many innovators are tinkering with business models to serve the market profitably.

Among the various players utilizing these emerging models in Africa are Mobisol (operating in Rwanda, Kenya, and Tanzania), Copia Kenya, and Nigeria’s Solo Phone. On the whole, these business models either reduce smartphones’ direct cost to consumers or provide consumers with financing or other purchase support.

Given the reliance of some of the most innovative global businesses on consumers’ access to the internet, the ability of similar businesses in sub-Saharan Africa to grow and achieve scale is significantly limited currently. While there are a number of other barriers to internet access in the region (e.g., high costs of mobile data), the emergence of these new business models to address the smartphone affordability gap is promising.

If you enjoyed this article, subscribe to be notified when more like it are published.

All charts in this article are from the GSMA and Dalberg’s recent report (PDF), ‘Accelerating Affordable Smartphone Ownership in Emerging Markets‘.

Share: